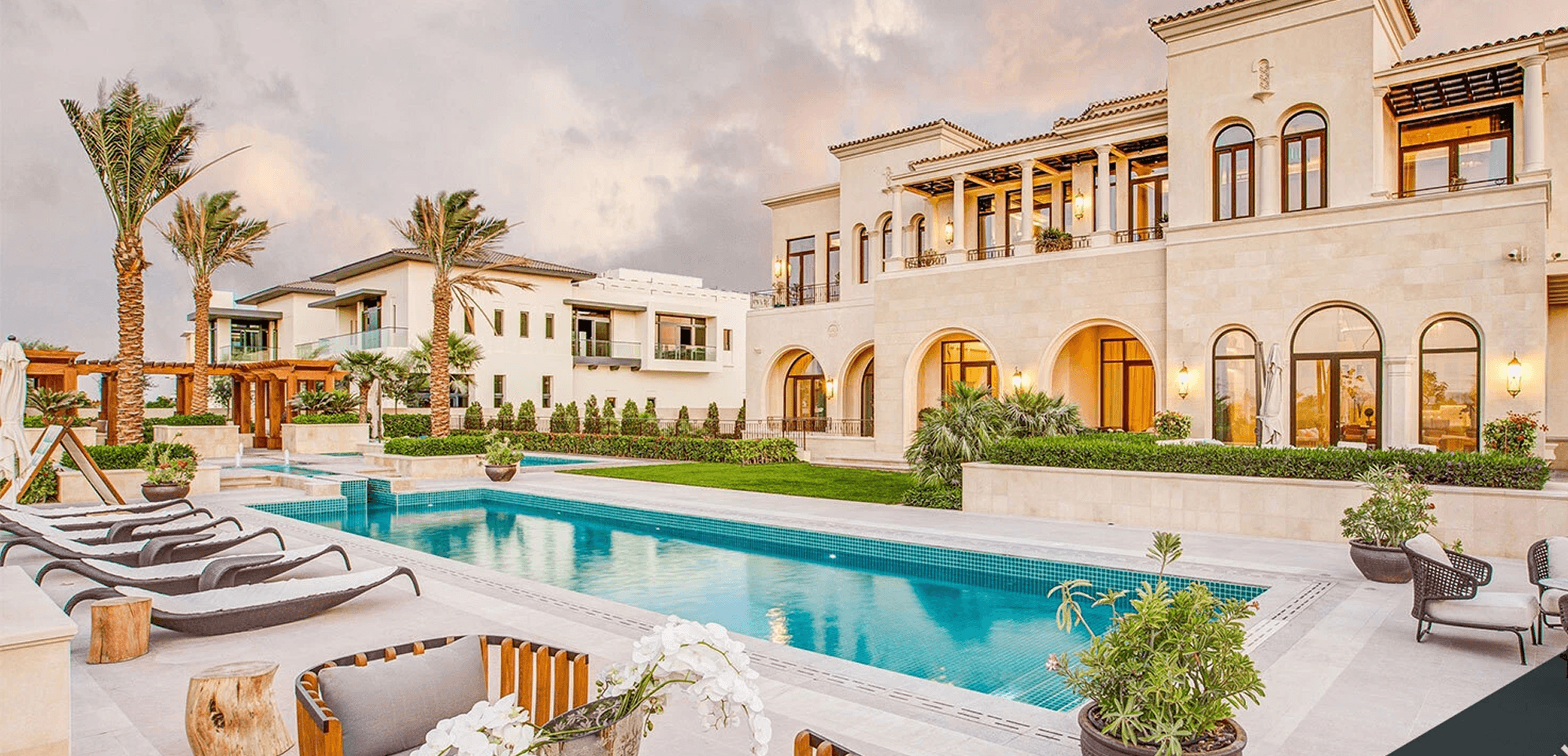

VACATION RENTAL

The UAE property market is experiencing a remarkable surge in demand as Europeans increasingly choose Dubai for its dynamic lifestyle and favorable business environment. Ali Sajwani, Managing Director of Damac Properties, attributes this trend to a mix of factors that make Dubai a prime destination for expatriates. These include the city’s tax-friendly policies, strategic location, and high standard of living.

Growing European Interest in Dubai Properties

Over the past year, there’s been a noticeable increase in property inquiries and transactions from Europeans, particularly from the UK, France, and Germany. This trend spans a broad demographic—not just affluent individuals but also middle-class professionals seeking opportunities in the UAE’s stable, post-pandemic economy.

Luxury residential properties, commercial real estate, and vacation homes are all witnessing significant demand. Dubai’s real estate market, which faced stagnation during the 2020 global slowdown, has rebounded as the city cements its status as a global hub for business, finance, and tourism.

According to the UAE Real Estate Market Outlook Mid-Year Review, there was a 94.1 percent rise in the overall volume of real estate dealings in Abu Dhabi during the first half of 2023 (H1 2023) when compared to the previous year. This growth was attributed to a remarkable surge of 160.4 percent in off-plan transactions.

Although the annual growth rate of average villa prices in Abu Dhabi has accelerated, the rate of growth for apartments eased during the second quarter of 2023. Nevertheless, CBRE expects a reversal of this trend as the year progresses.

In H1 2023, both Abu Dhabi and Dubai witnessed remarkable growth in real estate transactions. Abu Dhabi saw a 94.1% rise driven by a 160.4% surge in off-plan deals, while Dubai's transactions surged by 43.3%, elevating prices due to increased demand.

According to the UAE Real Estate Market Outlook Mid-Year Review, there was a 94.1 percent rise in the overall volume of real estate dealings in Abu Dhabi during the first half of 2023 (H1 2023) when compared to the previous year. This growth was attributed to a remarkable surge of 160.4 percent in off-plan transactions.

Conclusion

According to the UAE Real Estate Market Outlook Mid-Year Review, there was a 94.1 percent rise in the overall volume of real estate dealings in Abu Dhabi during the first half of 2023 (H1 2023) when compared to the previous year. This growth was attributed to a remarkable surge of 160.4 percent in off-plan transactions. Although the annual growth rate of average villa prices in Abu Dhabi has accelerated, the rate of growth for apartments eased during the second quarter of 2023. Nevertheless, CBRE expects a reversal of this trend as the year progresses. In H1 2023, both Abu Dhabi and Dubai witnessed remarkable growth in real estate transactions. Abu Dhabi saw a 94.1% rise driven by a 160.4% surge in off-plan deals, while Dubai's transactions surged by 43.3%, elevating prices due to increased demand.